Amidst the words of caution, there are encouraging signs that we are turning a corner.

The Bank of England (BoE) governor says the outlook for the British economy is among the worst in his working life and the Organisation of Economic Co-operation and Development (OECD) forecasts low growth for the UK in 2024.

Property prices are weakening but mortgage approvals are on the up, first-time buyers are enjoying the best market conditions in years, inflation has halved this year, and interest rates are expected to fall in 2024.

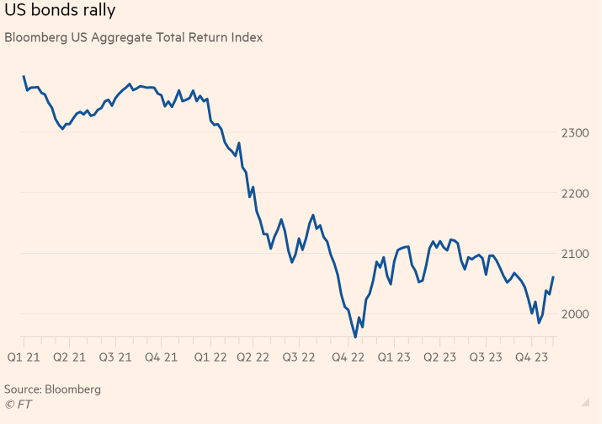

Good conditions for bonds to perform and encouraging from an equity point of view because we are getting closer to the recovery phase. Perhaps it’s already started and that certainly looks the case for bonds. See the graph below for US Bonds – the trend is not dissimilar for UK bonds.

Here is this week’s agenda:

- Every property cloud has a silver lining

- The worst of his working life!

- Lower UK growth for 2024

- Market Update

- Cash won’t be king

- Summary

Every property cloud has a silver lining

One in four sales are being agreed at 10% or more below the asking price according to Zoopla. They also say there has been a modest rebound in buyer demand, but it remains some 13% lower than at the same point in 2019.

Continues….

Want to continue reading?

Our CEO, Gary Neild, writes an engaging Market Commentaries every week. If you would like to receive the full version straight to your inbox every Friday, please join our communications list.

Risk warning

Please Note: This communication should not be read as giving specific advice regarding your personal circumstances. This would only be given following detailed assessment of your individual needs. The value of investments may fall as well as rise; you may get back less than invested. Past performance is not necessarily a guide to future returns.